reit dividend tax uk

20 tax on 17000 of wages. Delayed share data provided by.

Uk Reits A Summary Of The Regime Fund Management Reits Uk

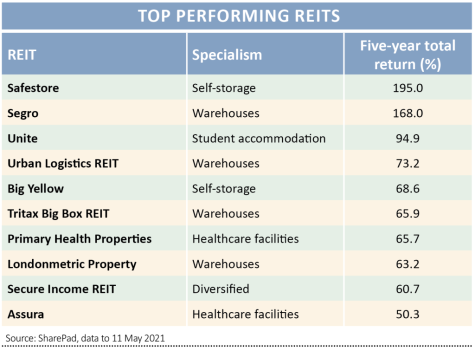

Our REITS Table shows 45 UK-listed REITs Click on the REIT to see more Yahoo Finance Data.

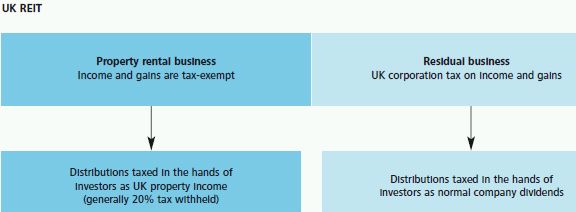

. Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs. Profits distributed as PID dividends are paid out of tax-exempt profits and therefore are potentially fully taxable in shareholders hands as property letting income. Completing individual UK tax resident tax returns.

Dividend distributions out of exempt rental income and exempt gains if distributed by the UK REIT are generally subject to a withholding tax of 20. How REIT Dividends Are Taxed. Although chargeable to tax as property income the PID should.

The previous UK Commercial Property REIT Limited. For example if the UK-REIT paid a normal dividend of 90 the tax credit was 10. 5 tax rate if shareholder owns more than 50 of the REITs shares for the 12 months before the dividend is.

The majority of REIT dividends are taxed up to the maximum rate of 37 percent as ordinary income plus a separate 38 percent investment income surtax. It stands out from this shortlist because its share price performance has been positive over the last 5 3 and 1. To qualify as a REIT the company must have at least 90 of its taxable income distributed to shareholders annually in the form of dividends.

The REIT is required to invest mainly in property and to pay out 90 of the profits from its property rental business as measured for tax purposes see IFM22050 as dividends to. A REIT are not eligible for the annual dividend tax allowance which is 2k in 202122. 10 tax rate if shareholder owns at least 25 of the REITs voting stock.

For UK resident individuals who receive tax returns any normal dividend paid by the UK REIT is included on the return as a dividend from a UK company. Email HMRC to ask. This tax credit met the tax bill for starting rate and basic rate taxpayers.

Investor After tax return from UK company After tax return from UK REIT Enhancement of return UK. PIDs received from a UK REIT including Landsec are treated as being taxable property letting income in the hands of. This corporation tax is paid by the company before any dividends are paid out to investors.

AEW UK REIT visit provider website currently has a dividend yield of 741. A UK-REIT is either a company or group that carries on a. The next UK Commercial Property REIT Limited dividend is expected to go ex in 2 months and to be paid in 3 months.

Any normal dividend paid by the UK-REIT is included as a dividend from a UK company in boxes 1015 to 1017 in the usual way. Your dividend voucher will show your. A normal UK company is required to pay Corporation Tax on profits at a rate of 19.

No tax on 2000 of. Since you would be in the basic rate tax band you would pay. REIT dividends and UK tax Scrip dividends IR contact information FAQs IR calendar Regulatory news Share price Open link menu.

However payments can be made gross. Take this off your total income to leave a taxable income of 20000. EPIC Name Market Cap m Dividend Price to Book Sectors.

Use form UK-REIT DT-Company to claim repayment of UK Income Tax deducted from property income dividends paid by UK Real Estate Investment Trusts.

Reducing Dividend Tax The Reit Way Shares Magazine

Uk Reits Property Investing Like A Boss Foxy Monkey

Do You Pay Taxes On Reit Dividends In Uk

Uk Dividend Tax 2020 Reit Dividends Tax Us Stocks Etc Youtube

How To Analyse Property Focused Investment Trusts Aka Reits Shares Magazine

Tax On Reit Dividends And Uk Dividend Tax Panda Boss

Uk Reits Property Investing Like A Boss Foxy Monkey

Reits A Force For Good Crestbridge

Guidance On Real Estate Investment Trusts

Uk Reits Property Investing Like A Boss Foxy Monkey

How Dividend Reinvestments Are Taxed

A Short Lesson On Reit Taxation

Reit Dividends And Uk Tax Assura

Us Reit Tax In Uk Investing Trading 212 Community

Tax On Reit Dividends And Uk Dividend Tax Panda Boss

Taxation Of Real Estate Investment Trusts Tax Systems